Ensuring you fulfil your obligation to give Zakat need not be complicated. With the ever-evolving financial landscape, many Muslims find it challenging to keep track of their annual Zakat payments. In this detailed guide, we’ll explore how Zakat is calculated, the importance of nisab, and how a dedicated tool like the MyZakat app can simplify the entire process—especially with its advanced AI features and built-in Zakat Calculator.

TL;DR

- Zakat Essentials: Every sane, adult Muslim with wealth above the nisab pays 2.5% of that wealth annually.

- Assets & Liabilities: Calculate Zakatable assets (cash, gold, silver, etc.) and subtract deductible debts (short-term loans, overdue bills).

- Nisab Threshold: Varies based on current gold/silver values. If net assets exceed nisab, Zakat is due.

- Calculating Zakat: (Net Assets) × 2.5% = Amount Owed.

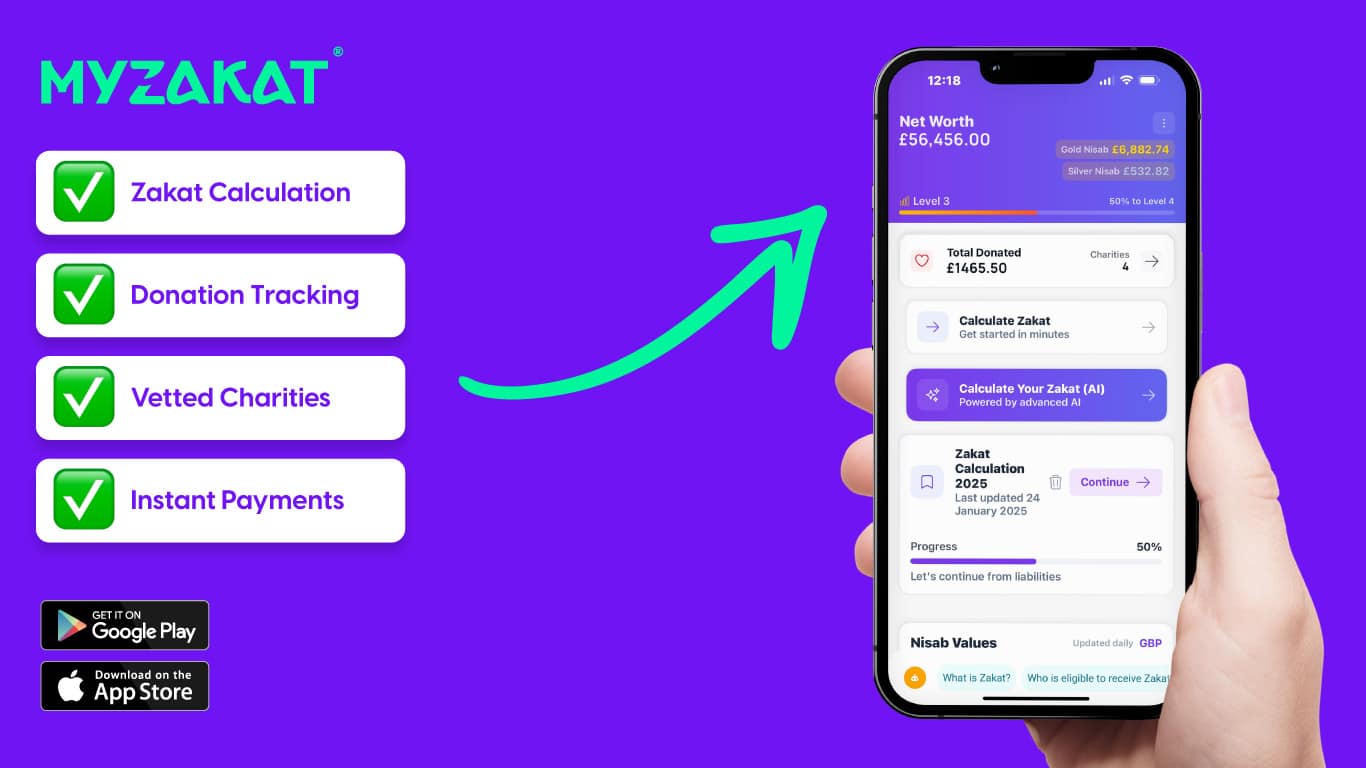

- MyZakat App: Streamlines everything with an AI-powered Zakat Calculator and keeps you updated on real-time nisab values.

Understanding the Basics of Zakat

Zakat is one of the five pillars of Islam. Every sane, adult Muslim who possesses wealth above the nisab threshold for a lunar year (354 days) is obliged to pay 2.5% of that wealth as Zakat. Before diving into the specifics of calculating Zakat, let’s clarify the two key components involved in the calculation:

Zakatable Assets

Zakatable assets are the forms of wealth on which Zakat is due. These include:

- Gold and silver (both jewellery and bullion).

- Cash (in hand, in bank accounts, or owed to you).

- Savings and investments (including shares and stocks).

- Business assets (merchandise, profits, etc.).

Deductible Liabilities

These are the amounts you can subtract from your total wealth before calculating Zakat. They typically include:

- Short-term debts (due within 12 months).

- Instalments for long-term debts that are payable in the coming year (such as mortgages or student loan repayments).

- Overdue bills or fines (arrears and overdue payments).

Once you subtract your deductible liabilities from your total Zakatable assets, you get your net assets. If this final amount meets or exceeds the nisab threshold, then Zakat is due at 2.5% of that amount.

Nisab: The Threshold for Zakat

The nisab is the minimum amount of wealth a Muslim must possess before they are eligible to pay Zakat. It’s calculated based on the current value of:

- 87.48 grams of gold, or

- 612.36 grams of silver.

Because market prices fluctuate daily, the nisab value changes accordingly. For example, on 10 February 2025, the approximate value of the nisab was:

- Using silver (612.36 grams): £505.49

- Using gold (87.48 grams): £6,508.14

You should check which value is most appropriate to your specific circumstances (many scholars recommend using the silver nisab to ensure you’re not missing the opportunity to give Zakat). (The MyZakat app automatically pulls latest nisab values and incorporates that into your zakat calculation.)

Remember that if your net assets are above the chosen nisab value, Zakat becomes obligatory.

How Zakat Is Calculated in 2025

Determining how Zakat is calculated involves six key steps:

- Identify your Zakatable assets: Calculate the total value of all eligible assets you’ve owned consistently for one lunar year (e.g., gold, silver, cash, savings, business stock).

- Determine your deductible liabilities: This includes any debts you owe and other outgoings due within the next 12 months.

- Calculate net assets: Subtract your deductible liabilities from your total Zakatable assets.

- Compare with the nisab threshold: Check if your net assets meet or exceed the current nisab value. If they do, Zakat is payable.

- Apply the 2.5% rate: Multiply your net assets by 2.5% (i.e., 0.025) to find out how much you owe.

- Pay your Zakat: Once you know the amount, distribute it to eligible recipients or through a reliable charitable route.

Tip: For complete accuracy and convenience, consider using the free Zakat Calculator in the MyZakat app. This tool, powered by advanced AI, ensures your calculations are up-to-date with the latest nisab values and financial considerations.

Example: A Step-by-Step Zakat Calculation

Let’s illustrate how Zakat is calculated using a simple scenario:

- Total Zakatable Assets: Suppose you own £1,000 worth of gold and silver, and you have £10,000 in savings. Total = £11,000.

- Deductible Liabilities: You owe a relative £1,000 and a fine of £500. Total liabilities = £1,500.

- Net Assets: £11,000 – £1,500 = £9,500.

- Check Nisab: If the nisab is approximately £505.49 (silver-based) or £6,508.14 (gold-based), your net assets exceed both thresholds, so Zakat is due.

- Zakat Payment: 2.5% of £9,500 = £9,500 × 0.025 = £237.50.

In this example, you’d owe £237.50 for Zakat this year.

How to Calculate Zakat on Specific Assets

Zakat on Cash

Calculating Zakat on cash is straightforward:

- Total all the cash you’ve owned for the past lunar year (including money in bank accounts, money at home, and amounts owed to you).

- Subtract any debts or immediate expenses.

- If the remaining cash meets or exceeds the current nisab, multiply by 2.5% to find your Zakat amount.

Note: Remember to combine this figure with your other Zakatable assets when making a final calculation.

Debts and Liabilities

When calculating how much Zakat you owe, certain debts can be deducted:

Deductible Debts

- Short-term debts payable within 12 months.

- Instalments due within the same period for long-term loans (e.g., mortgages, student loans).

- Overdue bills, fines, or arrears.

Non-Deductible Debts

- Expenses and bills not yet due.

- Debts not payable in the next 12 months.

- Interest payments (riba), as they are not considered permissible.

Additionally, if someone owes you money that you believe will be paid back, it is considered part of your Zakatable assets.

Zakat, Tax, and UK Regulations

Understanding the interplay between Zakat and UK tax laws can sometimes feel confusing. Generally, personal taxes—such as road tax and income tax—are not deductible unless they’re overdue. Money set aside for tax purposes can often be deducted from your total before calculating Zakat.

Making Zakat Easier with the MyZakat App

At MyZakat, we know that how Zakat is calculated can sometimes feel overwhelming. That’s why we’ve designed our Zakat Calculator with cutting-edge AI technology to ensure accuracy and efficiency. Our tool performs all the calculations for you—incorporating current nisab values, tax considerations, and any complexities related to your personal finances.

- Automatic Calculations: Enter your assets and liabilities, and let the app do the rest.

- Real-Time Nisab Updates: Our system checks the latest gold and silver prices so you always have the most recent threshold figures.

- AI Guidance: Our advanced AI will walk you through each step, minimising errors and confusion.

- Annual Reminders: You’ll receive timely notifications to pay Zakat when your year is up.

Ready to fulfil your Zakat obligation for 2025? Download the MyZakat app and benefit from an all-in-one platform that keeps track of your assets, calculates liabilities, and guides you through every stage of your Zakat journey.

Why You Should Download the MyZakat App Today

If you’re still pondering how Zakat is calculated and want an easier, more efficient experience, the MyZakat app is your go-to resource. Here’s why:

- Instant Zakat Calculation: Enter your details, and our built-in Zakat Calculator does the math automatically.

- Up-to-Date AI Insights: Our AI analyses your data and provides personalised guidance.

- Secure Records: Keep track of your annual Zakat history in one convenient location.

- Real-Time Nisab Updates: Rely on live price feeds for gold and silver to ensure accuracy.

Download MyZakat now on your preferred app store and prepare for a hassle-free Zakat payment in 2025 and beyond.

Calculating Zakat should be simple, transparent, and deeply fulfilling. By breaking your assets into clear categories and deducting eligible liabilities, you can easily determine your net assets and see if they exceed the nisab threshold. Once confirmed, paying 2.5% of your net assets ensures you uphold a key pillar of Islam while fostering social welfare.

With MyZakat’s advanced AI-powered Zakat Calculator, you can confidently navigate how Zakat is calculated in 2025, whether you’re managing cash, gold, silver, or business assets. Make your Zakat journey seamless—download the MyZakat app today and let technology simplify this vital obligation for you.